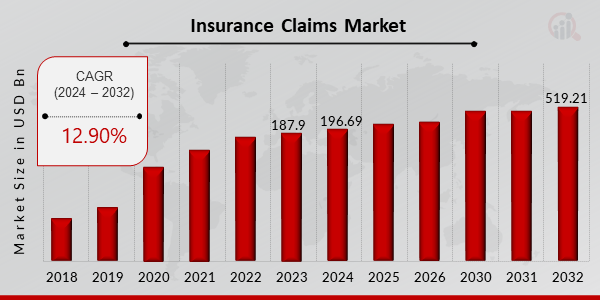

Insurance Claims Market is Expected to Generate USD 519.21 Billion by 2032 Growing at a CAGR of 12.90%

Insurance Claims Market Trends

Insurance Claims Market Research Report By Type, Subrogation, Claim Size, Processing Method, Regional

VT, UNITED STATES, February 14, 2025 /EINPresswire.com/ -- The global Insurance Claims market has experienced significant growth in recent years and is set to expand further over the coming decade. In 2023, the market size was valued at USD 187.9 billion and is projected to grow from USD 196.69 billion in 2024 to an impressive USD 519.21 billion by 2032, reflecting a strong compound annual growth rate (CAGR) of 12.90% during the forecast period (2024–2032). The growth is primarily driven by rising insurance penetration, advancements in digital claims processing, and increasing demand for faster and more efficient settlements.

Key Drivers of Market Growth

Rising Insurance Penetration

The increasing adoption of insurance policies across life, health, auto, and property sectors is fueling the demand for efficient claims management. Governments and financial institutions worldwide are promoting insurance coverage to enhance financial security, contributing to market expansion.

Technological Advancements in Claims Processing

Innovations such as artificial intelligence (AI), machine learning (ML), blockchain, and automation have transformed claims management. AI-driven chatbots, predictive analytics, and fraud detection systems have improved accuracy and efficiency, reducing processing time and minimizing fraudulent claims.

Growing Demand for Faster Settlements

Consumers now expect quicker claim approvals and payouts. The shift toward digital platforms, online claim submissions, and automated verification processes have streamlined operations, significantly reducing settlement delays and enhancing customer satisfaction.

Impact of Natural Disasters and Pandemics

Frequent natural disasters, including hurricanes, earthquakes, and floods, have led to a surge in property and health insurance claims. Additionally, the COVID-19 pandemic has heightened awareness of health insurance, driving an increased volume of claims and necessitating more efficient processing systems.

Regulatory and Compliance Requirements

Governments and regulatory bodies are enforcing stringent policies to protect policyholders and ensure transparent claims processing. Compliance with evolving insurance regulations has led to the adoption of digital solutions and automated workflows to enhance operational efficiency.

Download Sample Pages - https://www.marketresearchfuture.com/sample_request/24563

Key Companies in the Insurance Claims Market Include

• Allianz

• Ergo

• Generali

• Berkshire Hathaway

• Liberty Mutual

• Hiscox

• AIG

• AXA

• Swiss Re

• Ping An Insurance

• Munich Re

• Chubb

• China Life Insurance

• QBE Insurance

• Lloyds of London

Browse In-depth Market Research Report: https://www.marketresearchfuture.com/reports/insurance-claims-market-24563

Market Segmentation

To provide a comprehensive analysis, the Insurance Claims market is segmented based on type, end-user, deployment mode, and region.

1. By Type

• Health Insurance Claims: Driven by rising medical expenses and increasing awareness of health insurance.

• Life Insurance Claims: Includes maturity, death, and annuity claims.

• Auto Insurance Claims: Growing due to increasing vehicle ownership and accident rates.

• Property & Casualty Insurance Claims: Covers damages from natural disasters, theft, and accidents.

2. By End-User

• Individuals: Policyholders filing personal insurance claims.

• Businesses: Companies processing employee benefits, liability, and commercial property claims.

3. By Deployment Mode

• On-Premise: Traditional in-house claims processing systems used by large insurers.

• Cloud-Based: Growing adoption of cloud platforms for improved scalability, accessibility, and efficiency.

4. By Region

• North America: Leading market with a strong regulatory framework and high insurance adoption rates.

• Europe: Growth driven by increasing digitalization and regulatory mandates.

• Asia-Pacific: Fastest-growing region due to rising disposable income, expanding insurance coverage, and technological advancements.

• Rest of the World (RoW): Steady growth expected in Latin America, the Middle East, and Africa with improving financial infrastructure and insurance awareness.

Procure Complete Research Report Now: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=24563

The global Insurance Claims market is on a strong growth trajectory, driven by technological advancements, regulatory changes, and increasing consumer expectations for seamless claim processing. As insurers continue to invest in automation, AI-powered solutions, and digital platforms, the market is set to witness transformative changes, improving efficiency, reducing fraud, and enhancing customer experience. With vast opportunities across various regions and insurance segments, the future of the insurance claims industry looks promising.

Related Report –

Business Insurance Market

https://www.marketresearchfuture.com/reports/business-insurance-market-22853

Peer Analysis Market

https://www.marketresearchfuture.com/reports/peer-analysis-market-22876

High Net Worth Offshore Investment Market

https://www.marketresearchfuture.com/reports/high-net-worth-offshore-investment-market-22960

Lease Accounting And Management Software Market

https://www.marketresearchfuture.com/reports/lease-accounting-management-software-market-23203

Online Powersports Market

https://www.marketresearchfuture.com/reports/online-powersports-market-23212

About Market Research Future –

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Visit us on social media:

Facebook

X

LinkedIn

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release